Most of the money that the NBU will receive from payments by the Ministry of Finance will remain with banks, and the budget risks losing up to UAH 100 billion.

In 2022, the largest financial donor of Ukraine was not the US, EU or the IMF. Oddly enough, Ukraine itself was. More precisely, the National Bank, which borrowed UAH 400 billion last year.

The NBU remains the largest internal lender of the state today. The total government is to blame for the central bank almost UAH 700 billion, and spends tens or even hundreds of billions every year to serve this debt.

Budget debts to the National Bank look like transferring money from one "pocket" of the state to another. The fact is that the revenues that the NBU receives from the Ministry of Finance as payment of interest become part of the profit of the central bank, which is then transferred back to the budget.

However, in reality, this is not always the case. For example, in 2024, more than 80% of the funds that the state will translate between its "pockets" will be lost on the road.

Who really earns the government's debts to the National Bank and why does the budget lose it twice?

How many NBU government is to blame?

In order to cover the state budget deficit, the government releases the bonds of internal government loans (T -bills). In Ukraine, this tool is considered the most reliable, which is why it has become an important element of the financial market.

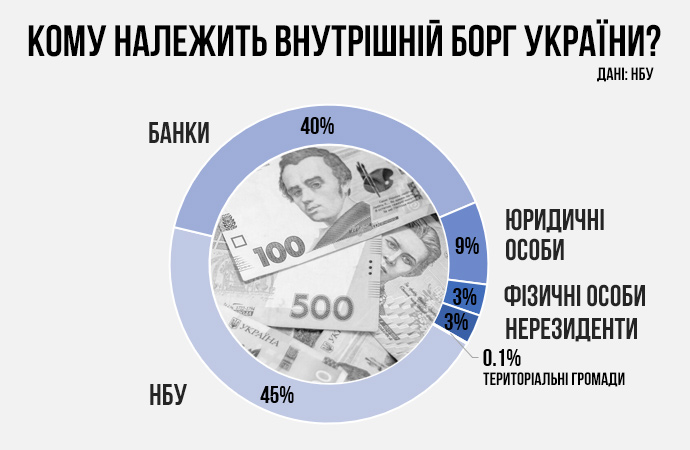

However, even banks do not invest in government bonds as much as the National Bank. The latter has bonds for a total of UAH 690.7 billion - 45% of the country's domestic debt.

To understand why the government is to blame the NBU's so much money, it is enough to remember the 2022th year. In the first months of the Great War, tax revenues declined sharply, and expenditures on the contrary increased. The budget was not enough, and international partners were not yet ready to allocate the necessary funding to Ukraine. It was at this point that the National Bank came to the rescue, to which the government sold bonds for UAH 400 billion.

Buying assets, including government bonds, the National Bank creates money and puts them into circulation. This process is called emission, and in the people - "printing" of money.

Released in 2022, the government bonds are the largest part of the budget debt to the National Bank. In order to release them, it was even necessary to change the law on the National Bank, which has a direct ban on "printing" of money for budget needs, as well as release a special government resolution .

These are 30-year bonds, the payment of the coupon for which is made once a year, and the amount of interest is the average amount of the NBU discount rate for the 12 months preceding the payment. For part of the issue (UAH 120 billion), a fixed rate is used at 11% per annum.

The regulator bought the rest of the NBU portfolio in previous years. The amounts and conditions of these securities are as follows:

- 2014 - UAH 12 billion, rate - 12.5% per annum, repayment will take place in 2024;

- 2015-UAH 35.25 billion, rate-11.18-12.5% per annum, repayment in 2025-2029;

- 2016-UAH 17.8 billion, rate-9.81-9.95% per annum, repayment in 2030-2031;

- 2017-UAH 223.46 billion, a rate for government bonds for UAH 78.29 billion-8.17-11.3% per annum, and for the rest-the inflation level "plus" 2.2%, repayment in 2025-2047.

The released in 2017, the government bonds are the result of re -professional or restructuring. Then the government exchanged bonds with a total value of UAH 220 billion for new ones, but with different dates of repayment so as to distribute evenly over time and not create a significant debt burden on the budget.

How much is the government's debt to the National Bank?

The NBU portfolio is debt, so you need to repay it. Given its size, it could be a real problem for the government in the future. However, fortunately, the repayment of these bonds is almost evenly scattered in time until 2052.

"Of course, the NBU portfolio is large and accounts for almost 46% of all government bonds in circulation. The highest amount of redemption is 2037, when the repayment of 120 billion hryvnias of military bonds will be redeemed. Kotovich.

These debts should not only be returned but also served, that is, pay interest. And the amount of payments for most of the government's debt to the NBU for UAH 425.18 billion - floating and depends on the inflation and discount rate. In other words, the Ministry of Finance is quite difficult to predict the future amount of payments.

According to the National Bank, in 2023 the government has to pay it in the form of interest for the T -bills 120.75 billion UAH . Of this amount, UAH 81.15 billion - coupon payments for the efficiency issued last year, and the remaining UAH 39.6 billion - coupons for the bonds of previous years.

In 2024-2025, the government's payments in favor of the NBU will be lower, as the discount rate and inflation will be lower to which such payments are tied.

From one pocket to another?

At first glance, it may seem that the government's debts to the National Bank is the transfer of money from one "pocket" of the state to another. According to the law, almost all of the NBU's profit received during the year should transfer to the budget.

In 2023, the NBU transferred to the budget almost UAH 72 billion of profit on the results of 2022, which fully offset the coupon payments of the Ministry of Finance in favor of the regulator for that year. However, this situation will not happen next year.

According to the Law on the State Budget for 2024, the treasury will receive only UAH 17.7 billion from the National Bank next year on the results of 2023. This is despite the fact that this year the Ministry of Finance has paid the NBU over UAH 120.75 billion percentage for government bonds. In other words, more than UAH 100 billion will be lost on the road between the "pockets" of the state (85% of government payments in favor of the NBU).

Where were UAH 100 billion lost?

To answer this question, you need to follow the money received by the government from the central bank for the T -bills in 2022. As mentioned above, every time the NBU buys bonds of the Ministry of Finance, it actually creates new money.

The NBU's issue in 2022 led to an increase in excess liquidity of the banking system. In other words, banks accumulated "extra" half a trillion hryvnia (at its peak, in July 2023, the amount reached UAH 579 billion). And it is almost impossible to get rid of these surpluses, whatever the action banks would take.

For example, if banks decide to spend all its excess liquidity on the purchase of government bonds, then the volume of this liquidity will still not change, because the government will again spend it on financing expenditures and it will return to the banking system.

Also, banks cannot issue loans for "extra" funds, because, first, during the war there is simply no solvent demand for such a significant resource. Secondly, given the risk of non-return of these funds, many banks could simply go bankrupt. And finally, bank lending will not change the total volume of liquidity in the system - the funds will simply move from one account to another.

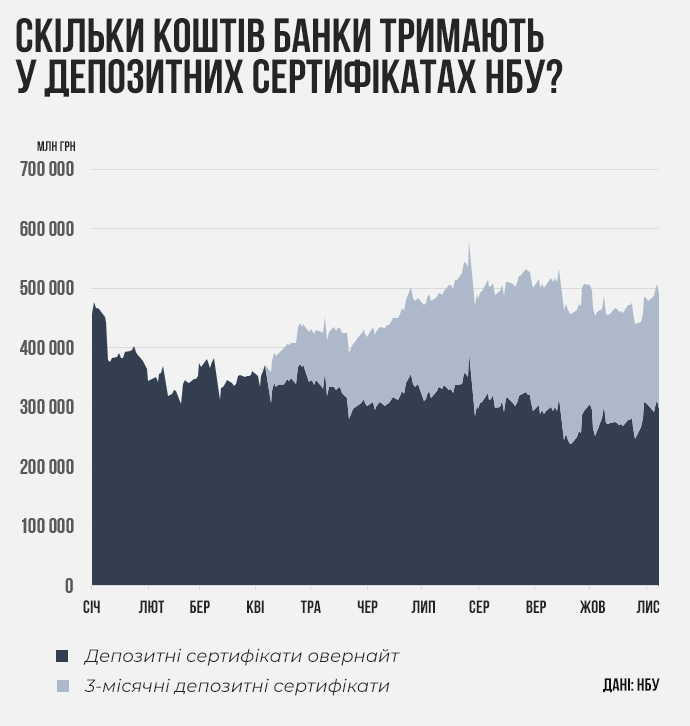

Not the only way to "remove" excess liquidity from circulation is to place it at the National Bank. This is done with the help of deposit certificates (DS) that banks buy in the NBU. However, withdrawal from circulation has its price. And it is measured as a percentage that banks receive for transferring their funds to the regulator.

The yield of DS depends on the discount rate. The DS Overnait rate (they retain most excess liquidity, the circulation of 1 day) is equal to the NBU's discount rate (16%), and for 3 months DS (they are allowed to fit banks depending on the volume of fixed-term deposits that they open their clients).

On November 9, banks kept more than UAH 492 billion in deposit certificates, of which 195 billion-three-month depths at 20% per annum.

According to the National Bank, on November 5, in 2023, UAH 73.5 billion . The regulator refused to reveal estimates of what the amount of payments in favor of banks in the total 2023 results, noting that "this issue is too sensitive."

"The estimated volumes of DS and payments for them are not public information, given its sensitivity, which is due to many factors, including those outside the NBU's direct influence (for example, receiving financial assistance from international partners by the government, its conversion to the hryvnia and the NBU).

The budget loses twice

If you summarize the movement of money that the NBU created during the issue, we can conclude that their considerable share will be "lost" in the profits of commercial banks. Of the UAH 120.75 billion, which the Ministry of Finance will pay for the National Bank for the T -bills, this year can settle in banks about UAH 88 billion of payments on deposit certificates.

NBU payments for deposit certificates have become one of the key prerequisites for the record profitability of the banking system. So, the day before, the National Bank reported that within 9 months of this year banks received UAH 110 billion in profit . It is clear that, as a result of the whole year, its size will increase even more thanks to stable payments for DS.

"Mathematically payments of the NBU in favor of banks (according to deposit certificates) eat its income, which it receives from the T -bills. Therefore, it turns Concorde Capital analytical department Alexander Parashii.

Not surprisingly, the Ministry of Finance is not delighted with this situation. Over the past two years, they have made at least two attempts to review their debt to the NBU.

In the summer of 2022, the deputies almost approved the norm that could oblige the NBU to automatically transfer interest income from the issuing ATP to the budget within 10 days after their receipt. And in the fall of this year, during the preparation of the budget-2024 for the second reading, the Ministry of Finance laid on him an article that could allow the government to carry out another refining of the government bonds owned by the National Bank.

Both attempts were unsuccessful, so commercial banks will continue to be enriched on the budget debts to the Central Bank. However, the NBU itself does not see anything wrong in this situation.

"The money earned remains in the system due to the prohibition for private banks in the course of martial law. Therefore, this profit remains with banks to increase their stability and maintain further active lending. Only stable banks are able to service the economy and return deposits to the population, support the country's restoration,"

The regulator adds that the current monetary policy, which is enriched with banks, has avoided further monetary issue in 2023, and retained the stability of the hryvnia. In the end, if the NBU did not "absorb" the excess liquidity of the banking system, it could roll into the currency market, "burn" gold and foreign exchange reserves and lead to a significant devaluation of the hryvnia.

What is the way out?

Are the budget that the budget was forced to take in the National Bank, now only large businessmen owned by Ukrainian banks are enriched? Yes, but partially.

The largest owner of banks in Ukraine is the state. It is at state banks that the overwhelming proportion of excess liquidity of the banking system is currently concentrated, since social payments, salaries of state employees and cash security are paid mainly to accounts opened with PrivatBank, Oschadbank and others.

Although state -owned banks earn the most on the excess liquidity of the banking system, most of these profits will be transferred back to the budget in the form of dividends next year.

As for non -governmental banks, which also accumulate excess liquidity, they cannot deduce their profits. Instead, these funds will be directed to cover the losses caused by the banking system to war.

However, here the state also found a way to return its. To do this, the parliament decided to introduce a tax tax for banks.

"Operational design of inflation targeting regime gives banks extra unpredictable income when increasing the key rate. Therefore, in many countries it is introduced in different forms of Windfoll Tax (tax on unpredictable income). This applies not only to banks but also other companies (eg, resource) Raiffeisen Bank Sergey Kolodiy.

Recently, Parliament approved in the first reading a bill , which is proposed to increase the rate of income tax for banks twice - from 18% to 36%. However, if it is approved as a whole, the new tax will only work from next year and will apply to the income that banks will receive in 2024.

"This idea is a little late, because next year the profits of banks will no longer be as significant: interest income will decrease much faster than expenses. But it does not look meaningless, especially some Western countries are already using such a tax," Parashii adds.

Therefore, this year the state actually supersedes the banking system. However, such a subsidy will not only support the stability of Ukrainian banks in the conditions of war, but will also allow them to earn a good money.