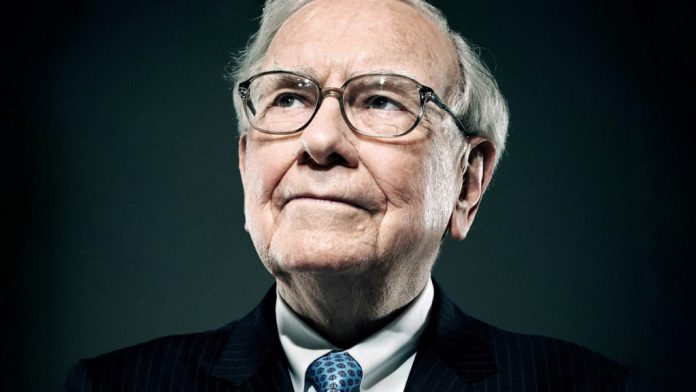

Відомий інвестор і фінансист Воррен Баффет, засновник інвестиційної компанії Berkshire Hathaway, нещодавно здивував ринок рішучими діями — продажем акцій найбільших американських компаній напередодні президентських виборів у США 2024 року.

Заяви та дії Баффета завжди привертають увагу інвесторів і можуть свідчити про очікувані зміни або ризики в економіці. Пропонуємо вважати, що можна спонукати легендарного інвестора до такого кроку та як це можна вплинути на фінансові ринки.

Його компанія Berkshire Hathaway повідомила, що продала 25% своїх акцій Apple протягом літа.

Також Баффет позбувся акцій Bank of America на кілька мільярдів доларів.

У підсумку, «грошова подушка» Berkshire Hathaway зросла до рекордної суми в $325,2 млрд.

Експерти, опитані Reuters, вважають, що накопичення готівки Баффетом означає «втечу від ризику», «і інвестори можуть турбуватися про те, що це означає для економіки і ринків».