The Ukrainian JSC "Commercial Industrial Bank), the ultimate beneficiary of which is the Crimean businessman with Russian passport, Eugene Kazmin, took the place of the IBOX bank in the shadow gambling market.

The role of Komingbank acts in the scheme for the legalization of gambling funds, in the investigation of 360ua.news

In addition to servicing the transactions of locals underground online casino, Cominbank activities may include another scheme-deduction of funds in Ukraine to finance "special projects of the Russian Federation", because of "winnings in online casino". It is worth noting that such schemes are almost impossible to track, unlike cryptocurrency operations, which are often blocked in the event of suspicion of financing terrorism or connections with the Russian Federation.

Considering the Russian background of the final beneficiary of Kominbank Yevgeny Kazmin and regular fines of the National Bank for violation of the rules of financial monitoring in the field of prevention and counteraction to the legalization (laundering) of income received by crime, the financing of terrorism is a lot of participation.

According to our source in the Security Service of Ukraine on the conditions of anonymity, financing of the subversive activity of agents of the Russian Federation in the territory of our country is in several ways. The first, when small amounts are transferred to the contractor directly to his bank card are used to work with "low -value" agents, such as those who transmit the coordinates of critical infrastructure. Such payments in combination with contact on the messenger are easy to track, using certain algorithms. The second - payment with cryptocurrencies, FSB is used for agents above, which will be more difficult to "replace" in the event of opening. This category can be conditionally attributed to political technologists and media people who have agreed to cooperate with the enemy. But cryptocurrency operations are "conditionally confidential" and are also monitored, although it is much more difficult.

However, if it is necessary to finance special operations of the GRU of the Russian Federation, or large -scale special operations for the destabilization of the situation (eg rails, shares of disobedience, corruption of top officials, etc.), other methods are used, which are almost impossible to monitor. Such methods include the involvement of Ukrainian banking institutions to translate significant sums, including through the shadow gambling market using the Miscoding Scheme. This kind of operation can only be detected by the National Bank using financial monitoring tools.

Thus, in September, the National Bank fined the Kominbank for the maximum amount of the fine - UAH 135.15 million. The sanctions were imposed for violation of the legislation in the field of prevention and counteraction to the legalization (laundering) of proceeds from crime, the financing of terrorism. According to the National Bank's official notification, there are, in particular, the failure of the functioning of a proper risk management system, the failure of a risk-oriented approach and the rejection of proper measures to minimize risks. In addition, the regulator accused Cominbank of providing false information for requests to fulfill the requirements of the law in the field of financial monitoring and information about foreign exchange transactions with errors, as well as improper verification of the payer.

It is worth noting that the regulator previously warned the Kominbank about the violation, imposing a fine of UAH 10.45 million for violation of the rules of financial monitoring and ordered the detected violations to be corrected. But it seems that the bank's owners are more profitable to pay penalties than to work in the legal field. It is worth mentioning here that Kominbank was previously illuminated in a large -scale investigation into the Bureau of Economic Security and the SBU at the end of last year.

“There is a documentation of the unlawful activity of business entities who have created a number of websites of doubles, which carry out illegal business activities in the form of online business, without payment of income tax, PIT and military fee. According to available information, the estimated monthly volume of shadow operations can reach 12 billion UAH. This, in turn, may amount to UAH 2 billion, ”Babs said in an official statement.

The investigation found that in order to cover the illegal activity, by prior conspiracy with officials of banking institutions of Ukraine and financial companies of both residents and non -residents, the mentioned group of persons used details of 80 economic entities with signs of fictitious.

In order to ensure illegal financial transactions, their missing and the avoidance of primary financial monitoring, the actual owners of these companies have entered into a criminal conspiracy with banks.

Miscoding-coding manipulation when instead of a four-digit payment code 7995, which belongs to gambling, any other was indicated. Thus, sports or payments in online casinos at banks were paid for video games, buying flowers and more. Or, on the other hand, the bank, having received money from the gambling business to pay the winner, sends it under the code also of a completely different industry, or even conducting it as a regular transfer from a card to a card.

According to a number of media outlets, the Kominbank transaction under code 7994-video game purchase-in the last one and a half or two years amounted to 90% of the total volume, which according to experts is over UAH 120 billion.

The IBOX Bank mentioned above with Kominbank served shadow schemes of gambling businesses, according to the investigation, earned more than UAH 2.5 billion annually on gambling. It is logical that the Kominbank beneficiary is ready to pay 135 million penalties, and will still remain a huge plus. Therefore, it is possible to put an end to the fraud only by withdrawing the license of the financial institution, with the subsequent criminal prosecution of its owner.

And with the owner of the "commercial industrial bank" everything is very interesting.

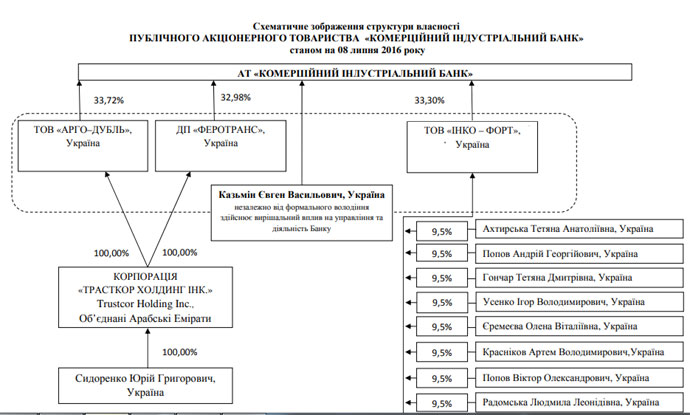

Since the end of 2016, Kominbank has been controlled by British subject to Stefan Paul Pinter ( as of March 8, 2023, he had 94.86% of the bank's shares, another 5.14% owned the chairman of the Board of the Financial Institution Tatiana Putintseva). According to the official legend, the British investor purchased Cominbank for $ 5 million from a major Crimean merchant scrap Yevgeny Kazmin in 2016.

According to NewEurope , Stefan Paul Pinter is a founding partner, CEO and Main Investment Director of GML International Limited, a company founded in 1983 to provide corporate and state consultations, collect and raise debts, and account for debts. Later, the firm expanded its activities, including the creation and structuring of new sources of financing for banks, companies and governments of developing countries in the international markets of syndicated loans, bonds and trade financing.

In 1996, GML launched its first investment fund, which followed a series of developing markets, has representative offices in Kiev, Moscow, Genoa, Tbilisi, Istanbul, Almaty, Bucharest and Belgrade. In 2007, consulting and management directions were distinguished into a separate structure of GML Capital LLP. GML International Limited acts as a managing member of GML Capital LLP. The final beneficiary of both companies in the British Register indicated Stefan Paul Pinter.

Actually, GML International Limited and GML Capital LLP, which is part of its structure, are sources of income of Stephen Pinter. And if you delve into the financial reporting of these companies (you can get acquainted here and here ), there will be a suspicion that these "enterprises" could hardly generate capital for their beneficiary to buy the Kominbank in 2016. After all, their annual net profit was measured not in millions, but in hundreds of thousands of pounds. That is, we will carefully assume that in this story Stefan Paul Pinter acts as a "pound".

Who then bought Kominbank from Yevgeny Kazmin? The analysis of the facts indicates that Eugene Kazmin himself is a bush.

Recall that cominbank for a long time belonged to the head of the concern Edaps Yuri Sidorenko . In 2015, Crimean businessman Yevgeny Kazmin agreed with Sidorenko on the purchase of a bank for $ 4.2 million. From that moment on Cominbank, scandals and criminal cases. Former Cominbank Security Head Anatoly Mazur spoke about the details of the purchase of Financial Institutions.

According to him, the businessman did not have legal funds, so he had to deceive the National Bank when buying. A lawyer hired to buy a bank in a package of documents for the NBU submitted a falsified declaration, according to which the source of funds for the purchase of a bank is the sale of coins to a dead person purchased from a dead person, and the operation was issued by a late notary. The NBU did not believe this story and did not allow Kazmina to issue a bank on itself. As a result, the nominal shareholders of Cominbank became legal entities that were founded by employees of companies of the Crimean businessman. In March 2016, Kazmin became the chairman of the Bank's Supervisory Board, and the National Bank soon recognized him with the ultimate beneficiary of the financial institution .

On April 28, 2016, Kazmin was detained by SBU staff on suspicion of financing separatism in Crimea . In other words, the SBU found that after annexation, the businessman continued to do business on the occupied peninsula, paying his baby's budget. Kazmin went to the pre -trial detention center.

In the early 2000s, Yevgeny Kazmin engaged in the collection and disposal of scrap in Sevastopol, and later the construction business was added. Then the business expanded to the mainland of Ukraine, a group of companies of KVV groups appeared. Kazmin himself became a deputy of the Sevastopol City Council from the Party of Regions, and in 2012 he even found himself on the Yanukovych party in the elections to the Verkhovna Rada, however, he did not get to parliament.

When Russia occupied Crimea, Kazmin went to the mainland of Ukraine and stated that it did not conduct business on the peninsula and was not related to property, strategic and operational management of construction sites on the peninsula.

It was quickly revealed that it was not true, and the Kazminy family re -registered assets in the Russian Federation and continues to work in the Crimea. The edition of Crimea . Karbon LLC, which earlier belonged to Eugene Kazmin, has actively built real estate in Sevastopol and other regions of the peninsula for many years.

In November 2014, the company was re -registered under Russian law. Then the name of Yevgeny Kazmin disappeared from the founders and leaders. At the moment, his brother Vladislav Kazmin owns his brother.

In the State Register of Enterprises and Organizations of Russia there are other enterprises belonging to the members of the Kazmin family. They still receive large contracts from the State Budget of the Russian Federation. Moreover, journalists found out that these firms helped Kazmina through the offshore chain of offshore.

In addition, the former head of the Kazmin Holding Holding Service Anatoly Mazur claims that even after the annexation of Crimea, the businessman illegally exported the scrap to Turkey.

The SBU accused Yevgeny Kazmin of the fact that under his direct guidance in the Crimea was built housing, some of which was intended for free to provide the FSB staff and the Ministry of Internal Affairs of the aggressor country. It is the so-called "town of Peace", which Karbon-Bud company, owned by Kazmmin, was erected on the outskirts of Simferopol.

It is worth noting that during the searches of Kazmin found a Russian passport. The investigation also received evidence of Russian citizenship businessman. Among other things, a wristwatch with the image of the coat of arms of Russia and the inscription "Moscow-Kreml", apparently presented to the defendant for special merit before the "new" homeland, was found during the search by the investigation.

However, despite the documentary evidence that appeared in the case, after five months, the prosecutor who conducted criminal proceedings filed a petition for the release of Kazmin from criminal liability. The reason for this was the fact that the suspect voluntarily informed the investigation of his financial activity, which later became the subject of consideration, even before he was charged with the relevant article .

When the KVV group owner was at large, he found out that he had lost part of the business. Its raider was taken away by the former business partners. Kazmin himself acted in the same way when the Athek Kiev Plant raid .

Despite the partial loss of business, the Bank of Eugene Kazmin has retained. In the summer of 2016, while in a pre -trial detention center, he allegedly sold a bank to a "foreign investor". In fact, it was a re -registration of a financial institution for a false person - British Invest Banker Stefan Paul Pinter - in order to save the asset.

Despite the fact that the legal address of the bank-Boulevard-Kudryavska, 6, the real location of the office-Predslavinskaya, 28. It is at this address is the KVV Group office.

Our source at the Bank states that in Predslavinskaya Kazmin personally participates in meetings of the board and essentially manages the financial institution.

The Bank's security service was headed by Andriy Ryazhsky, the head of the KVV Group SB. Ryazhsky until September 2016 was the chairman of the Karbon Kazmin's RB, which is still owned by the businessman's family and pays taxes to the budget of the Russian Federation.

Many KVV Group employees still work in the bank structure. And lawyer Yevgeny Tip, which in 2015 falsified documents for the purchase of a treasury bank, is now the deputy chairman of the Cominbank Supervisory Board .

In the photos, Kazmin stands next to the chairman of the board of the bank Tatiana Putintseva. This photo was taken after 2019, when Putintseva was headed by the bank.

As we can see, there are good reasons to believe that "Kominbank" is still controlled by Yevgeny Kazmin, a citizen of the aggressor country, so we ask that this journalistic investigation should be considered an official request to the SBU, in order to verify the facts stated in the article.